#Turbotax login online software#

So for example, if you had bought crypto on Coinbase and then transferred it to Gemini to sell it, as these are both supported exchanges in TurboTax, then the software will be able to track your cost basis. TurboTax says its software can track the cost basis of cryptocurrency for supported exchanges. Can TurboTax track the cost basis of cryptocurrency?

#Turbotax login online how to#

We have a help guide on how to export your key from these wallets for Koinly users. Phantom and Atomic for Solana), you'd need to combine multiple CSV files and format them to the TurboTax universal CSV format before you could upload them.Īs well as this, there are a number of popular wallets where exporting your xpub key is difficult. If you're using multiple wallets for the same cryptocurrency (i.e. You may be able to use a blockchain explorer with a CSV export option to get around this, but you will need to format your CSV file to fit the TurboTax universal CSV file format. For integrations where CSV is the only data import method supported, many wallets do not support CSV file export.

#Turbotax login online full#

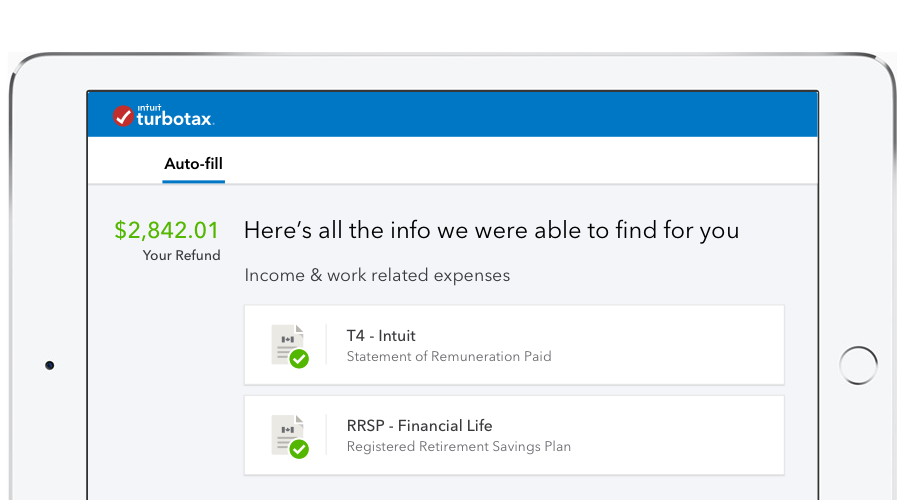

Here's a full list of the exchanges supported currently, and how they're supported: Users can either connect using API, or upload a CSV file - but often the CSV file types are not supported by TurboTax and you'll need to manually edit them, or the API is limited in the data it returns. TurboTax supports 10+ of the most popular crypto exchanges to varying degrees. Which crypto exchanges does TurboTax support? Skip ahead for instructions on how to file with TurboTax and Koinly. This is why most investors opt to use TurboTax with a crypto tax calculator like Koinly - and this guide covers exactly how to file using TurboTax and Koinly. But for most crypto investors, the current integrations are too limited (both in number and the data automatically imported) to calculate your crypto taxes accurately. Overall, if you have very basic transactions from crypto exchanges that TurboTax supports, you may be able to do your crypto taxes using TurboTax. As well as this, the automatic crypto import options for TurboTax are only supported for TurboTax Online, not TurboTax CD/Download (desktop). Yes, TurboTax Online somewhat supports cryptocurrency transactions, but the software isn't specifically designed to calculate or file crypto taxes and while the platform supports some popular exchanges and wallets, the integrations offered are far too limited for most crypto investors. TurboTax is one of the most popular tax preparation software in the United States and is used by millions of taxpayers each year to help them file their state and federal taxes online, either solo or with the help of an accountant.

It offers a range of features such as step-by-step guidance, a user-friendly interface, and tools to help users identify tax deductions and credits.

TurboTax is a tax software program developed by Intuit that enables individuals and small business owners to prepare and file their taxes electronically. Using TurboTax for crypto taxes, but no clue how to file them? Use our step by step guide for US investors on how to file your crypto tax with TurboTax and Koinly in 2023.

0 kommentar(er)

0 kommentar(er)